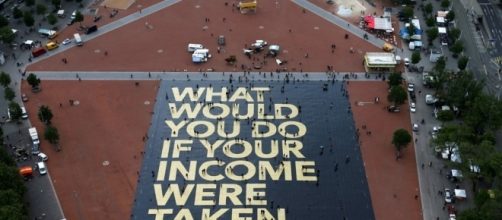

Universal Basic Income is not a new concept, in fact, a similar proposal has been around since the 18th century. The premise is very straightforward. Citizens are provided with a basic income, which has no conditions attached. Every member of society would be entitled to the payment regardless of their income, savings or employment status.

The main difference with universal basic income in comparison to other forms of social welfare is the lack of bureaucracy attached with the payment. There are very few forms to fill out, the payment is not means tested and there is no ongoing process to contend with, like having to attend interviews or to continue to re-register in a system.

How does it impact on people?

The payment is not meant to allow the person to live an affluent life. The idea is simply to remove the fear of financial ruin. The payment should provide individuals and families with a basic financial safety net.

The scheme is currently being trialled in a number of countries across the world. One of the largest trials has been running in Finland since 2017, where two thousand unemployed people were selected to receive universal basic income for a period of two years. The income is currently equal to around twenty percent of the average monthly national income.

What are the benefits?

A recipient is free to undertake and pursue Work they want to. In the trials to date, this has led to the recipients working longer hours and led to more productive work as people are enabled to follow their passion.

The lack of paperwork and the pure simplicity of the scheme also enables more focus on passion projects and not being weighed down by the system.

When comparing basic income to universal credit, the difference can be seen in the incentive for the recipients to work under the universal basic income. There is no consequence to engaging in full-time work and the removal of the layers of paperwork and conditions to be adhered to would make the system more straightforward.

But where will the funding come from?

There have been a number of questions asked about how the project will be financed. The answer appears to lie in the current taxation model. By reducing the current tax credits that are made available and increasing tax revenues in other methods, the model appears to be viable for funding.

Due to the simplicity of the system, there is not the same need for staff as there is in order to maintain the current Social Welfare System. Personnel and system savings can be made here in order to fund the universal basic income.

Many point out this programme should be the way forward for all economies regardless of the social welfare system as more jobs are challenged by increasing automation. It would provide families and individuals with an income whether they are working or not and would encourage people to become more entrepreneurial.

Most governments appear to be happy to debate the topic right now and seem to be intrigued with the concept, however, we still seem to be a long way from seeing a government embracing it in full. Only time will tell if the current UK government will be the first to embrace it, however embracing radical social welfare changes appears unrealistic given the current government tensions.